The Main Principles Of What Is Trade Credit Insurance

Wiki Article

The 45-Second Trick For What Is Trade Credit Insurance

Table of ContentsThe 9-Minute Rule for What Is Trade Credit InsuranceWhat Is Trade Credit Insurance for DummiesRumored Buzz on What Is Trade Credit InsuranceSome Of What Is Trade Credit Insurance

This is provided by some profession finance professionals covering the possible hold-ups to settlement which could come from money transfer constraints, or the bankruptcy of a government purchaser. Our political threat insurance helps organizations to secure their abroad financial investments in situations such as political physical violence or confiscation of assets, or other threats relating to the activities of an international federal government.In some situations it does function out much greater than this if there is imperfect credit history or other red flags. As with any kind of insurance, there is a computation to be done around threat.

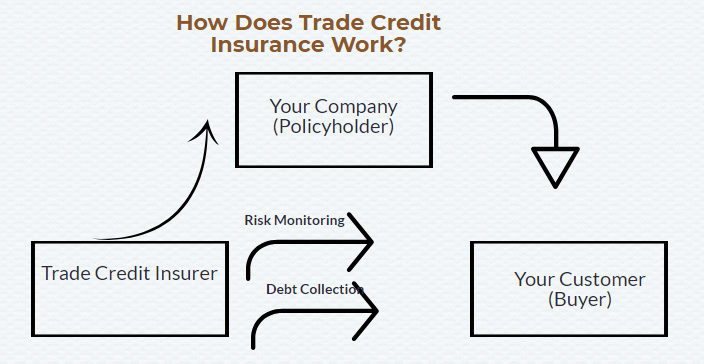

They allot each of those customers a quality that reflects the health and wellness of their task and also the method they carry out service. Based on this risk assessment, each of your buyers is then granted a particular credit line up to which you, the insured, can trade and be able to case must something go wrong.

The Buzz on What Is Trade Credit Insurance

The guarantees will certainly cover trading by residential firms as well as exporting companies as well as the intent is for contracts to be in position with insurance providers by end of this month. The guarantee will be short-term as well as targeted to cover Covid-19 financial obstacles, as well as it will be followed by a testimonial of the TCI market to ensure it can best sustain organizations in future.It is important to obtain the details right to make sure that the scheme helps organizations as well as insurers, as well as additionally offers worth for money for the taxpayer. It is important that insurance firms can keep their underwriting criteria and also take the chance of administration methods, to guarantee that assistance is supplied to services that can trade out of the existing circumstance - What is trade credit insurance.

Offered the sudden disturbance to financial activity, and the enhanced dangers of insolvency as well as default out there, trade debt insurance companies might right away withdraw several of the protection that they presently provide in order to continue to be viable. The choice would certainly be to increase premiums to a level that is uneconomical for all celebrations.

Profession credit history insurance plays a specifically substantial duty in non-service fields, such as production and also construction, giving services the confidence to patronize one another. The Federal government is keen to make sure that these fields are not take into further distress as a result of the Covid-19 crisis. This scheme will certainly guarantee that supply chains continue to be protected from the prospective domino result of trade disturbance as well as service defaults.

What Is Trade Credit Insurance Things To Know Before You Buy

The final plan is most likely to share similarities with some of the other interventions launched across the continent. Nevertheless, the information are still being finalised by web the UK Federal government and also being reviewed with insurers. More detail will certainly be announced in due training course. The government is dealing with industry to finalise the details of the plan.

The Federal government's priority for this system is to function with insurance providers to sustain UK services. It is the Federal government's intent that this plan will permit the trade debt market to run as typical, as far as possible.

Rumored Buzz on What Is Trade Credit Insurance

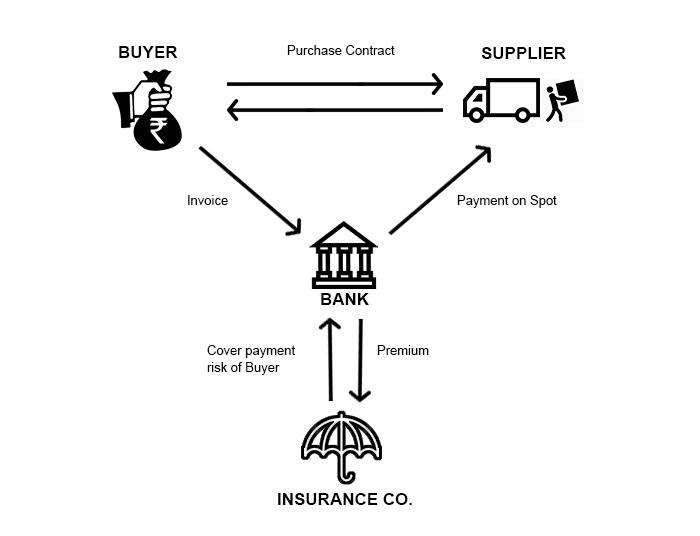

Additional details of the system will certainly be announced in due course. The Government's top priority for this plan is to sustain UK businesses that can be impacted by the withdrawal of profession credit score insurance policy cover throughout the Covid-19 situation. In the longer term, it will certainly be proper to examine the effectiveness of this treatment, examine how the marketplace replied to financial interruption, and also think about just how it can remain to finest offer businesses.While the biggest operators out there are abroad firms, this is not a bailout for insurance companies. We are collaborating with the insurance firms to finest assistance British companies. Trade credit score insurance coverage offers security for services when consumers do not pay their financial next obligations owed for items or services. The plan will certainly repay the insurance holder in the occasion of the purchaser's non-payment, as much as a particular credit rating limit set by the insurer.

This could worsen the financial impacts of the pandemic by creating issues for liquidity as well as working funding for purchasers as well as destructive depend on in visit the website supply chains.

The sales of goods and solutions are exposed to a substantial number of dangers, much of which are not within the control of the vendor. The greatest of these risks as well as one that can have a catastrophic influence on the feasibility of a provider, is the failure of a buyer to spend for the products or services it has purchased. What is trade credit insurance.

Report this wiki page